Unlocking Minority Owned Business Benefits

Getting certified as a minority-owned business isn't just paperwork; it's one of the smartest strategic moves you can make as an entrepreneur. This official status is like a key that unlocks a whole new world of opportunities, including exclusive grants, lucrative government contracts, and valuable corporate partnerships that can put your business on the fast track to growth.

The Power of Minority Owned Business Certification

Think of your minority-owned business certification as less of a label and more of a VIP pass in the business world. It’s the official recognition that your company is at least 51% owned, operated, and controlled by one or more U.S. citizens from a designated minority group. This isn’t just for show—it's a powerful asset that helps level the playing field.

With this certification, you gain a direct line to opportunities that are often completely out of reach for your uncertified competitors. Why? Because major corporations and government agencies are actively looking for certified businesses to meet their supplier diversity goals. This means your business can land on preferred vendor lists, giving your visibility and credibility an instant boost.

Unlocking a Suite of Growth Tools

Certification is the crucial first step. It's the gateway to a powerful set of advantages specifically designed to promote economic equity and help your business thrive by tackling historical barriers to funding and market access.

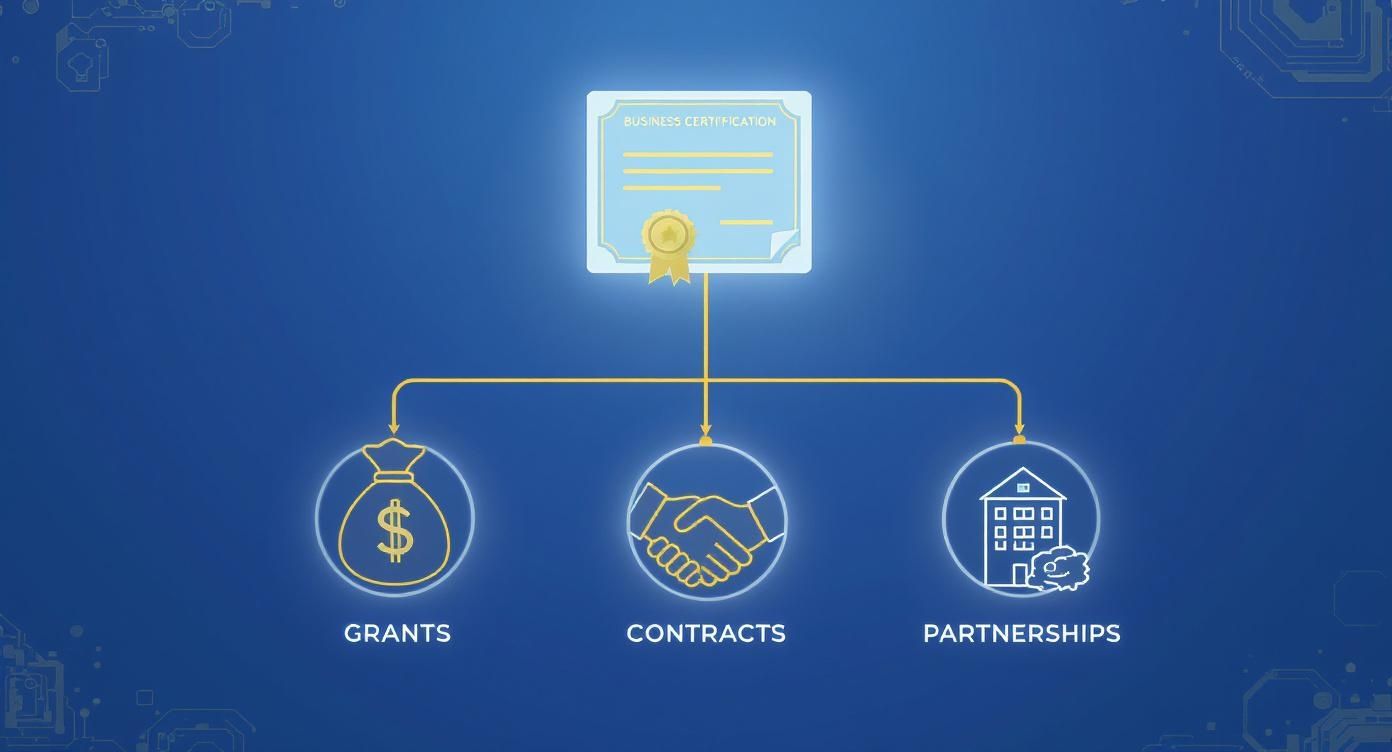

This infographic breaks down how certification becomes the foundation for accessing grants, contracts, and partnerships.

As you can see, that certificate is the central piece that opens the door to three critical pillars of business expansion.

Certification transforms your business from just another vendor into a sought-after partner, opening doors that were previously closed and providing a direct line to decision-makers actively looking to diversify their supply chains.

But the benefits don't stop at contracts and funding. Becoming certified plugs you into a supportive network of fellow entrepreneurs and dedicated organizations. This ecosystem offers mentorship, training, and strategic alliances that are truly invaluable for long-term success.

These connections are especially vital in creative industries, where unique voices and fresh perspectives can really shine with the right support. We see this with many talented handbags by African American designers, whose incredible work gains a much larger platform through these very channels. This guide will walk you through exactly how to use this powerful certification to its absolute fullest potential.

Securing Exclusive Grants and Better Financing

Let's be honest: capital is the lifeblood of any growing business. For minority entrepreneurs, getting access to that capital has historically been a massive uphill battle. This is where certification truly shines, creating a powerful advantage by opening doors to financial resources specifically designed to level the playing field.

Think of it this way: certification acts as a key, unlocking a whole new set of opportunities. It gets you in front of people who are actively looking to fund businesses just like yours. This isn't just about survival; it's about giving you the fuel to truly thrive.

Finding and Winning Financial Support

A grant is basically a non-repayable investment in your company's future—money for new equipment, marketing, or expansion that you don't have to pay back. Countless federal, state, and private foundations have funds set aside specifically for certified businesses because they understand the immense value you bring to the economy.

Diving into the world of grants can feel like a lot, but you don't have to go it alone. Agencies like the Minority Business Development Agency (MBDA) exist for this very reason. They offer incredible programs and resources to help minority-owned firms nail down funding and scale up. If you're just getting off the ground, learning about government grants for startups can be an absolute game-changer for securing that crucial early-stage cash.

Beyond grants, certification also puts you in a much better position for special loan programs. These aren't your average bank loans; they often come with some serious perks:

- Better Interest Rates: A lower rate means more money stays in your pocket over the life of the loan. Simple as that.

- More Flexible Requirements: Lenders in these programs are often more understanding when it comes to credit scores or collateral.

- Favorable Terms: Think longer repayment periods, which can make your monthly payments much more manageable.

These programs are a direct response to the systemic roadblocks many have faced in lending. And while there's still work to be done, things are looking up. The loan approval rate for Black-owned firms recently hit 6.5%, a notable jump from 4% in 2017. With 84% of Black/African American business owners expecting their revenue to grow, the optimism is real and backed by progress.

Getting a grant or a favorable loan is so much more than a simple financial transaction. It’s a vote of confidence. It's an institution saying, "We believe in you," giving you both the capital and the validation to chase even bigger goals.

Making Your Application Stand Out

To get your hands on these funds, your application needs to do more than just check the boxes—it needs to tell a compelling story. Show them your vision. Clearly explain how this money will help you create jobs, serve your community, or bring a new innovation to life.

A polished, well-prepared proposal shows you’re a professional who means business. It proves you have a clear plan for success, making it that much easier for them to say "yes." This proactive approach is exactly how you break through old funding barriers and get the support you need to build something amazing.

Winning Government and Corporate Contracts

Think of your minority-owned business certification as more than just a piece of paper. It's an all-access pass to the multi-billion dollar world of supplier diversity. Major corporations and government agencies aren't just hoping to work with diverse suppliers—they often have specific, mandated goals to do so. This creates a powerful, built-in demand for businesses just like yours.

Imagine a Fortune 500 company or a federal agency that needs anything from catering to graphic design. They keep a preferred list of pre-approved vendors, and your certification is what gets you on that exclusive list. It can often put you ahead of uncertified competitors before you even submit a proposal.

This isn't about waiting for them to find you. It's a proactive approach to procurement where large organizations are actively seeking you out. Your business shifts from being just another face in a crowded market to a highly sought-after partner, which is one of the most powerful minority owned business benefits out there.

So, What Are Supplier Diversity Programs?

At their core, supplier diversity programs are strategic initiatives that encourage large organizations to buy from businesses run by underrepresented groups. But don't mistake this for just a social responsibility checkbox; it's a proven business strategy. Partnering with diverse suppliers is known to spark innovation, build resilience, and boost profitability.

The numbers don't lie. Research from The Hackett Group found that companies with strong supplier diversity programs can generate a 133% greater return on their procurement investments. For every dollar they spend on procurement operations, they get an extra $3.6 million for their bottom line. That's a serious competitive edge.

These programs aren't just about hitting a quota. They are about building a stronger, more adaptable supply chain. By actively seeking out minority-owned businesses, corporations and government bodies unlock fresh perspectives and clever solutions that give them a real advantage in the market.

To get in on these opportunities, you first have to make your business visible. The most immediate, practical step is getting registered in the right supplier databases.

Supplier diversity programs can seem complex from the outside, but they typically revolve around a few key elements. Understanding these components will help you navigate the process and position your business for success.

Key Supplier Diversity Program Components

| Component | Description | How to Leverage It |

|---|---|---|

| Certification | Official verification that your business is at least 51% owned and operated by a minority individual or group. | This is non-negotiable. Get certified through recognized bodies like the NMSDC or your state's MWBE program. |

| Supplier Portals | Online databases where procurement officers search for certified diverse suppliers for upcoming projects. | Register your business in all relevant federal, state, and corporate portals. Keep your profile updated. |

| Tier 1 & Tier 2 Spending | Tier 1 is direct spending with a diverse supplier. Tier 2 is when a company's main contractor (prime) subcontracts to a diverse supplier. | Target both. You can work directly with a corporation (Tier 1) or partner with one of their larger, non-diverse suppliers (Tier 2). |

| Spending Goals | Corporations and government agencies set public goals for the percentage of their budget they will spend with diverse businesses. | When pitching, reference their diversity goals to show how hiring you helps them succeed. |

| Matchmaking Events | Networking events hosted by large organizations to connect their procurement teams directly with certified suppliers. | Attend these events to build personal relationships with buyers and decision-makers. |

By familiarizing yourself with these terms and structures, you can confidently engage with procurement teams and demonstrate that you understand their needs—not just as a service provider, but as a strategic partner.

Getting on the Right Vendor Lists

Becoming a registered supplier is how you get your foot in the door. These databases are the very first place procurement officers look when they have a new project. Think of them as a private LinkedIn, but exclusively for certified businesses and the big players that want to hire them.

Here’s where you should start:

- National Minority Supplier Development Council (NMSDC): This is the gold standard for corporate supplier diversity. The NMSDC network connects certified minority business enterprises (MBEs) with thousands of America’s top corporations.

- System for Award Management (SAM.gov): If you want to do business with the U.S. federal government, you must be registered here. SAM.gov is the official portal for all federal contracting opportunities.

- State and Local Portals: Don't forget about your own backyard! Many states and cities have their own MWBE (Minority/Women-owned Business Enterprise) certification and supplier portals. A quick search for your state's program can unlock a stream of local government contracts.

Once you’re registered, it’s all about crafting proposals that speak directly to what procurement officers need. Make sure to highlight your certification right at the top, clearly explain your unique value, and show how hiring you helps them hit their diversity spending goals while receiving top-notch work. This strategic move transforms your certification from a simple status into a powerful engine for securing stable, high-value revenue for years to come.

Using Tax Incentives to Fuel Your Growth

Beyond the world of grants and contracts, some of the most powerful benefits for a minority-owned business are hiding in plain sight: strategic tax advantages. Most entrepreneurs see the tax code as a burden, but it's time to shift that perspective. Think of it as a toolbox, filled with incentives you can use to lower what you owe and keep more of your hard-earned cash right where it belongs—in your business.

This isn't about finding sneaky loopholes. We're talking about legitimate, government-backed programs designed specifically to encourage economic growth.

The money you save on taxes can be put to work immediately. It could become your next big marketing campaign, a down payment on that piece of equipment you've been eyeing, or the salary for a critical new hire. This creates a powerful cycle where smart financial planning directly fuels real, tangible expansion.

Unlocking Key Federal and State Credits

Many tax incentives are actually tied to actions that help the community, creating a true win-win. The government essentially rewards you for making a positive local impact. For any entrepreneur, getting a handle on the available essential small business tax deductions is a fantastic starting point for maximizing your financial position.

You'll find several powerful tax credits available at the federal, state, and even city level. Some of the most common ones to look for include:

- Work Opportunity Tax Credit (WOTC): This is a big one. It's a federal credit that rewards employers for hiring people from certain targeted groups, like military veterans or individuals from families receiving public assistance.

- HUBZone Program: While most people know it as a contracting program, operating your business in a Historically Underutilized Business Zone (HUBZone) can also unlock unique tax advantages.

- State-Specific Hiring Credits: Don't forget to look locally! Many states offer their own tax credits for creating jobs in economically distressed areas or hiring from specific local populations.

What makes these so valuable is that they are credits, not deductions. They reduce the amount of tax you owe dollar-for-dollar.

Tax incentives are the government’s way of investing in your success. By hiring from your local community or operating in a designated economic zone, you’re not just saving money—you’re becoming a partner in community revitalization.

How Companies Supporting You Also Benefit

Here's where it gets even better: the advantages don't just stop with you. Corporations that partner with certified minority-owned suppliers can often receive tax breaks of their own.

This is a massive motivator for them to actively seek out businesses like yours. It directly benefits their bottom line.

When a large company buys products or services from you, they may become eligible for federal tax incentives. Suddenly, your certification isn't just an asset for you; it's a valuable selling point for your potential clients, giving you a serious competitive edge.

Build a Brand That Truly Connects

Think of your minority-owned business certification as more than just a piece of paper for grants or contracts. It’s a story—and in today's world, a powerful story is your best marketing tool. People are actively looking to support businesses that stand for something real.

Your certification tells a story of resilience, vision, and community. When you share the unique journey behind your brand, you’re not just selling a product; you're inviting customers to be part of that story. This is how you build a tribe of loyal supporters who champion your brand because they believe in what you’re doing.

It's More Than Customers, It's a Community

Beyond winning over customers, your status as a minority-owned business opens the door to an incredible support system: minority business councils and professional organizations. These aren't your typical stuffy networking events. They are genuine communities built by people who get it because they’ve been there.

In these circles, you'll find real, practical help:

- Mentorship Programs: Get advice from entrepreneurs who have already navigated the path you're on.

- Strategic Partnerships: Team up with other minority-owned businesses to land bigger projects or explore new markets.

- Real-World Wisdom: Swap stories and get honest advice from peers who truly want to see you win.

These groups transform the lonely road of entrepreneurship into a shared journey. They offer a place to grow, strategize, and build real connections with people who understand.

This sense of community is making a huge splash on a national scale. There are roughly 9.7 million minority-owned small businesses in the U.S. today. Together, they generate an annual revenue of about $1.78 trillion and provide jobs for 9.4 million people. Those numbers show the incredible power and impact of this sector. You can dive deeper into the economic stats over at the U.S. Chamber of Commerce.

By weaving your unique story into your brand and plugging into these supportive networks, you're doing so much more than just growing a business. You're building something that connects with people on a deeper level and contributes to a much larger movement. You can see this in action with the amazing success of independent creators, like the ones featured in our guide to inspiring Black-owned handbag brands that are making waves.

How Your Success Builds a Stronger Economy

Tapping into the benefits available for minority-owned businesses does more than just help your company grow—it creates powerful ripples that spread across the entire economy. Your success is a direct investment in your community, creating jobs and building a more resilient nation. This isn't just about fairness; it's a proven strategy for making our economy stronger for everyone.

When your business thrives, you become a pillar of progress. You create jobs right where they’re needed most, often in underserved communities. That generates local wealth that keeps circulating, supporting other small businesses and strengthening the local tax base, which in turn helps fund essential public services.

A Driving Force for Job Creation

The ambition brewing in the minority business community is a massive engine for employment. Just look at the numbers. Recent findings show that about 71% of Black-owned businesses are planning to hire more full-time staff, and 55% are looking to add part-time roles. These numbers are way ahead of the broader business community, showing a real commitment to growth. You can dive deeper into these hiring trends and what they signal for the economy.

This forward-thinking approach to hiring does more than just bring down unemployment rates. It helps build a more diverse, skilled workforce that sparks innovation from the ground up.

By succeeding, your business becomes a testament to what's possible. You’re not just an employer; you are an inspiration, encouraging the next generation of diverse entrepreneurs to pursue their own visions.

Your Journey Is Part of a Larger Movement

At the end of the day, your journey as an entrepreneur is a vital piece of a much bigger economic story. Every contract you win, every person you hire, and every product you sell helps build a more inclusive and vibrant economy. Your success directly challenges old barriers and paves the way for a more equitable future.

The tools and strategies we've talked about—from getting certified to joining supplier diversity programs—are all designed to help you on this mission. As you grow your company, like many of the successful Black-owned purse companies making their mark, you’re cementing your role as a leader who builds not just a business, but a stronger, more prosperous community for all of us.

Frequently Asked Questions

Navigating the world of minority-owned business benefits can definitely bring up a few questions. Don't worry, we've got you. This section provides direct, clear answers to help you understand the landscape and take your next steps with confidence.

Who Qualifies for Minority-Owned Business Certification?

So, how do you get officially certified? Your business needs to meet a few core requirements. The big one is that the company must be at least 51% owned, operated, and controlled by U.S. citizens who belong to a designated minority group.

These groups typically include individuals who are Black or African American, Hispanic or Latino, Asian American, or Native American. It's not just about ownership on paper, either—the daily management and long-term strategic decisions must also be in the hands of these minority owners.

Where Can I Find Grants for My Business?

Finding the right grants starts with knowing where to look. Thankfully, several key resources are dedicated to connecting minority entrepreneurs with funding opportunities specifically set aside for them.

- The Minority Business Development Agency (MBDA): This federal agency is a fantastic starting point, offering grant competitions and tons of business support.

- Grants.gov: Think of this as the central station for all federal grants. You can filter opportunities by eligibility, including your minority-owned status.

- Private Foundations: Don't forget to look beyond government sources. Many corporations and foundations, like the Amber Grant Foundation, offer funds specifically for minority and women entrepreneurs.

How Do I Start Getting Corporate Contracts?

Landing those big corporate contracts really begins with making your business visible to the procurement officers who are actively searching for diverse suppliers. The first step is getting certified through an organization they recognize, like the National Minority Supplier Development Council (NMSDC).

Once you're certified, your very next move is to register your business in corporate supplier portals. These are the internal databases large companies use to find and vet potential partners for upcoming projects.

By getting registered and keeping your profile updated, you put your business directly in their line of sight. Attending supplier diversity events and networking with procurement teams are also fantastic ways to build the relationships that lead to long-term partnerships—and unlock one of the most powerful benefits of being a minority-owned business.

At The Bag Icon, we believe in celebrating and empowering entrepreneurs from all backgrounds. Explore our collection of affordable luxury handbags designed for the modern, ambitious woman and find the perfect accessory for your journey to success. Discover your next favorite piece at https://www.thebagicon.com.

Comments